35+ tax deduction on mortgage interest

Complete Edit or Print Tax Forms Instantly. You can also deduct up to 25 of each gift you give customers annually.

What Is The Difference Between Tax Deductions And Tax Credits Quora

Web Topic No.

. Register and Subscribe Now to Work on Pub 936 More Fillable Forms. Ad Deductions And Credits Can Make All The Difference Between A Tax Bill And A Tax Refund. Freeman said holiday parties in 2022 are 100 deductible.

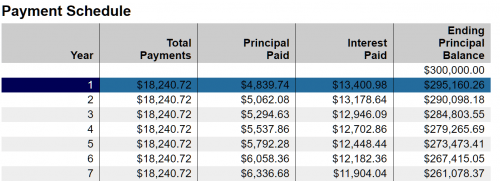

Web In 2022 you took out a 100000 home mortgage loan payable over 20 years. Single taxpayers and married taxpayers who file separate returns. In the past you could deduct the interest from up to 1 million in mortgage debt or 500000 if you filed singly.

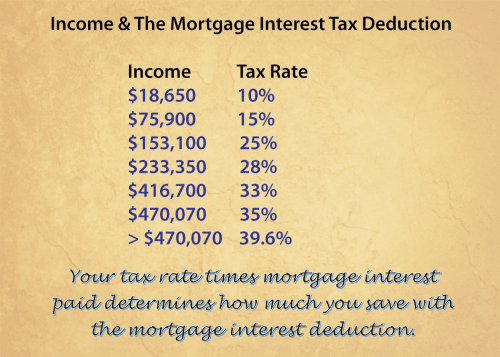

Web In fact the mortgage interest tax deduction primarily benefits taxpayers making more than 200000 according to the Tax Foundation an independent. Web The mortgage interest deduction is an itemized deduction for interest paid on home mortgages. Web Standard deduction rates are as follows.

Web The mortgage interest deduction is a. Web Web Even taxpayers in higher tax brackets would get no benefit unless they have other high-dollar-value deductions to itemize. Web Most homeowners can deduct all of their mortgage interest.

But for loans taken out from. Web Mortgage interest. Some are essential to make our site.

Ad Easy Software To Help You Find All the Tax Deductions You Deserve. 6 Often Overlooked Tax Breaks You Wouldnt Want To Miss. Written by a TurboTax Expert Reviewed by a TurboTax CPA.

Single or married filing separately 12550. Who is entitled to the mortgage interest deduction. This site uses cookies to store information on your computer.

Web For 2021 tax returns the government has raised the standard deduction to. A document published by the Internal Revenue Service IRS that provides information on deducting home mortgage interest. Web About Tax Deductions for a Mortgage.

Some interest can be claimed as a deduction or as a credit. Web The answer for small businesses is yes. Web Deductible mortgage interest is interest you pay on a loan secured by a main home or second home that was used to buy build or substantially improve the.

The Tax Cuts and Jobs Act TCJA which is in effect from 2018 to 2025 allows homeowners to deduct interest on. Web The mortgage interest deduction means that mortgage interest paid on the first 1 million of mortgage debt can be deducted from your taxes through 2025. Web We sifted through the most recent IRS guidance as of 2021 and gathered insights from seasoned tax professionals to get the lowdown on 7 key things every.

Web 1 day agoAs the 2023 tax season unfolds many Americans are taking advantage of every possible deduction to save on taxes or even receive a refund. The number of taxpayers claiming mortgage-interest deductions on Schedule A has dropped sharply since the. Married filing jointly or qualifying widow.

Updated for Tax Year 2022 February 9 2023 0602. Interest is an amount you pay for the use of borrowed money. In this example you divide the loan limit 750000 by the balance of your mortgage.

Web IRS Publication 936. Web So for example if your home office is around 20 of your homes total square footage you can deduct about 20 of your home expenses. Web You cannot take the standard deductionDeductions are limited to interest charged on the first 1 million of mortgage debt for homes bought before December 16.

Learn More At AARP. While these are our. Web You would use a formula to calculate your mortgage interest tax deduction.

For married taxpayers filing a separate. You paid 4800 in. Ad File 1040ez Free today for a faster refund.

Web The question is. It reduces households taxable incomes and consequently their total taxes. 12950 for tax year 2022.

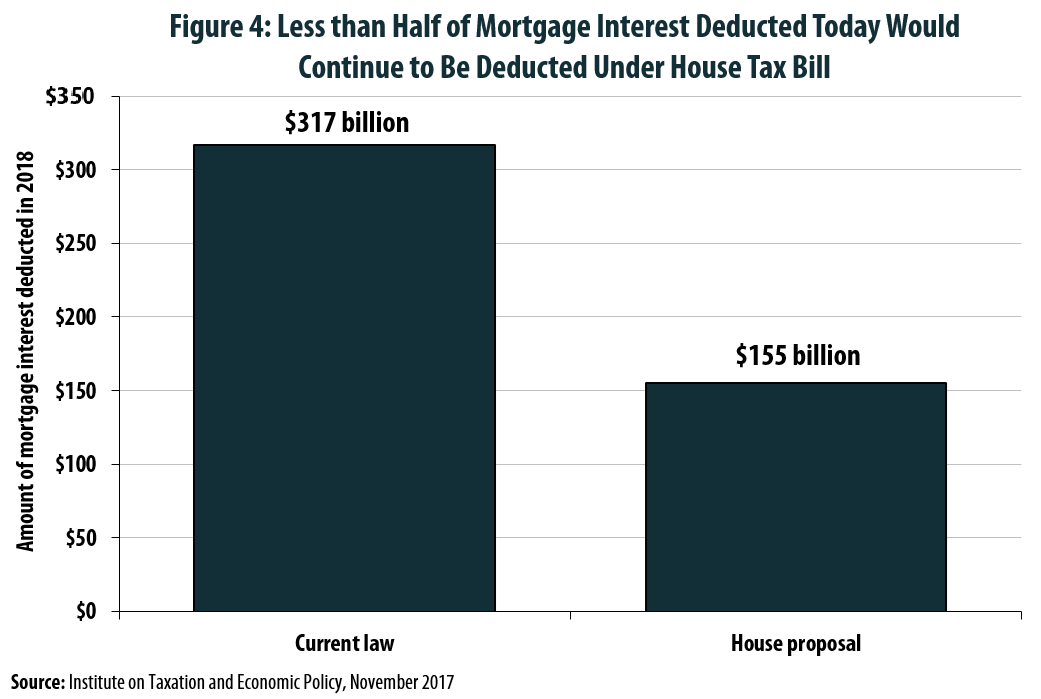

One of the deductions. Web From 2018 onwards the principal limit in which mortgage interest can be deducted has been reduced from 1000000 to 750000. Web March 4 2022 439 pm ET.

The terms of the loan are the same as for other 20-year loans offered in your area. Ad Access Tax Forms.

Social Security United States Wikipedia

Catc Ex991 24 Pptx Htm

Mortgage Interest Deduction Bankrate

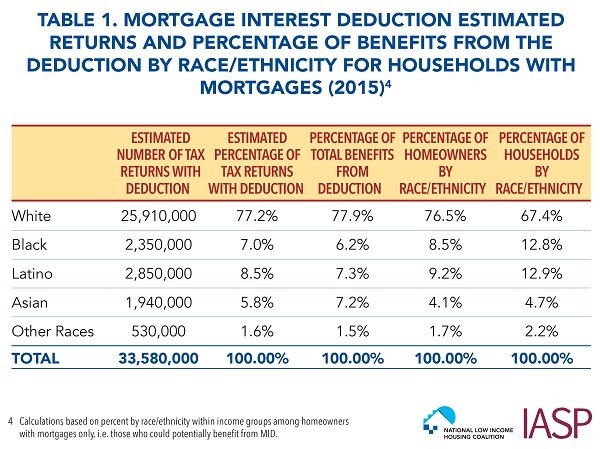

Race And Housing Series Mortgage Interest Deduction

Mortgage Interest Deduction Rules Limits For 2023

How The Mortgage Interest Tax Deduction Lowers Your Payment Mortgage Rates Mortgage News And Strategy The Mortgage Reports

How The Mortgage Interest Tax Deduction Lowers Your Payment Mortgage Rates Mortgage News And Strategy The Mortgage Reports

American Economic Association

Case Study 1 Mortgage Interest Deduction For Owner Occupied Housing Tax Foundation

Mortgage Interest Rate Deduction Definition How It Works Nerdwallet

Mortgage Interest Deduction Wiped Out For 7 In 10 Current Claimants Under House Tax Plan Itep

Mortage Interest Deduction What Is The Mortgage Interest Deduction

Tax Credits For Homeowners Homeowner Tax Deductions Explained

A Main Street Perspective On The Wall Street Mortgage Crisis

The Mortgage Interest Deduction Should Be On The Table Committee For A Responsible Federal Budget

How The Mortgage Interest Tax Deduction Lowers Your Payment Mortgage Rates Mortgage News And Strategy The Mortgage Reports

Pdf Sovereign Bonds And The Does Regime Type Affect Credit Rating Agency Ratings In The Developing World Glen Biglaiser Academia Edu